Residential Tax Exemption Remains Steady, But Select Board Considering Future Changes

JohnCarl McGrady •

Nantucket’s residential tax exemption will hold steady at 25 percent this year, though most homeowners will see an increase to their bills as property values continue to rise across the island.

The Select Board voted unanimously to leave the exemption at 25 percent, but several members called for a more detailed hearing before next year’s adjustment to consider increasing the exemption and easing the burden on local homeowners.

“I want to have a public discussion of the impact and solicit input,” Select Board member Brooke Mohr said. “We need to have a much more robust conversation about what this all means.”

“I’d like to slate this for an agenda in early spring,” Select Board chair Dawn Hill said. “To have a really detailed discussion about the residential exemption.”

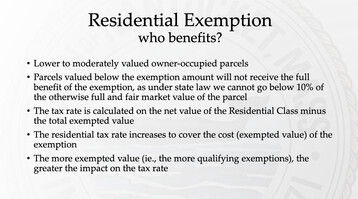

The residential exemption allows towns to shift taxes from owner-occupied residential properties, primarily those with lower property values, to vacation homes, higher valued homes, and other residential properties not occupied primarily by the owner, including apartments and vacant land.

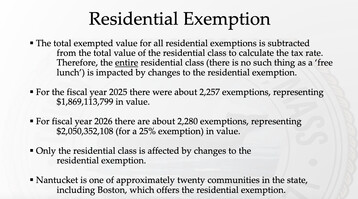

The maximum allowed exemption, now that Nantucket is designated as a seasonal community under the new state law, is 50 percent. This rate is based on the average residential value for the island, which is currently $3,597,109, meaning that a 25 percent exemption shaves $899,277 off a qualified property's value for property tax assessment purposes.

Mohr initially pushed for an increase to the exemption on Wednesday.

“I think now is the time for us to think about going to 30 percent,” she said. “We do want support from the voters on capital projects, and I think that providing some relief to the year-round residents on their regular tax bill leaves a little bit of room for support on capital needs that we have that are growing.”

Nantucket’s housing director agreed.

“There's a lot of people who are lucky to be homeowners who are really starting to feel priced out, and that is motivating them to sell,” housing director Kristie Ferrentella said. “I'm just wondering if it's time to inch up a little bit, knowing that that could help preserve some of the people that are here.”

But the majority of the board indicated that they wanted to hold the remainder of the exemption in reserve and deploy it in the future, as the amount of tax revenue needed for capital projects increases.

Hill also emphasized that increasing the exemption wouldn’t decrease the overall tax burden; it would just shift it onto other homeowners.

“For a rental property,” she said, “it would increase the tax.”

Ultimately, the vote was unanimous.

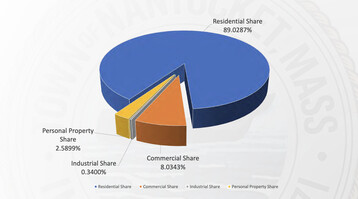

While some Select Board members worried that increasing the exemption could harm local businesses, shifts to the residential exemption do not impact the tax rate for commercial property. The percentage of the tax levy paid for by residential property remains constant regardless of the exemption rate. Increasing the exemption only affects which residential properties are responsible for that levy.

Commercial enterprises could be affected if they operate employee housing, as those properties are residential and are not owner-occupied.

The Select Board also opted to keep the 1.7 percent tax levy shift onto commercial, residential, and personal property. This shift reduces the tax burden on residential property.