Island's Short-Term Rental Tax Revenue Plunged 27 Percent In Summer 2024

Jason Graziadei •

Short-term rental occupancy tax revenue collected by the town of Nantucket decreased significantly last summer, plunging by 27 percent compared to the prior year.

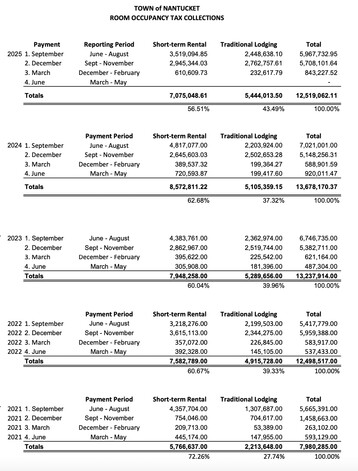

Short-term rentals operated on the island in June, July, and August generated $3.5 million in taxes, according to figures obtained by the Current from the Nantucket Finance Department. That represented a 27 percent decrease over the same period in 2023 and was the second-lowest amount generated on Nantucket during the summer months since the state implemented the short-term rental tax in 2019.

Meanwhile, room occupancy taxes collected by the town from traditional lodging establishments like inns and hotels increased to $2.4 million for the summer, up 11 percent from the same period in 2023.

Even as the debate over how to regulate or restrict short-term rentals on Nantucket continues to unfold - with voters being asked to evaluate several new proposals at this year's Annual Town Meeting next month - the drastic decrease in tax revenue from vacation rentals is prompting stakeholders on both sides of the debate to pause and take stock of the market ahead of the 2025 summer season.

The tax revenue generated by short-term rentals is driven by both the number of contracts signed, as well as the rates charged by vacation rental operators. In the summer of 2023, despite a drop in the number of contracts, short-term rental rates continued to climb leading to record-breaking revenue from the town. That upward trend has now reversed sharply. But what is driving the decrease?

"I'm seeing more ads (for short-term rentals) on Facebook, there have been more houses added to our rental inventory, and I'm seeing more vacancies, I believe, due to higher pricing than in the past," said Brian Sullivan, a principal broker with Fisher Nantucket and vice president of the Nantucket Association of Real Estate Brokers (NAREB). "I feel like there is more available inventory for summer 2025 than last year and the year before...Nantucket has its own level. Anytime the increases go above six or seven percent on an annual basis, it goes out of whack, and that happened in the COVID period. I think now it's swinging back."

Nantucket's local option room occupancy tax allows the town to collect 6 percent of the revenue generated by operators of both traditional lodging establishments and short-term rentals. The state collects another 5.7 percent.

Since the state legislature and former Massachusetts Gov. Charlie Baker approved the legislation that subjects short-term rentals to the room occupancy tax in July 2019, the revenue has become a significant portion of the town's budget. In FY2024, the town received room occupancy tax revenue from traditional lodging establishments and short-term rentals in excess of $13.6 million, more than 10 percent of the town's total revenue.

"Rentals are definitely down and, I believe, could be below the 2019, pre-pandemic levels," said Penny Dey, broker and owner of Atlantic East Real Estate and the past president of NAREB. Rental data from the past two years is still being compiled, Dey said.

Peter McCausland, the founder of the political action group ACK Now which has been at the center of the short-term rental debate, said he was somewhat puzzled by the significant drop in tax revenue from vacation rentals.

"I am not sure what this means," McCausland said. "It could mean that rent prices are down post-pandemic and that actual rentals are up or unchanged. The testimony at the Ward 2 trial was that rentals were down only slightly. Whatever the reason, it does not impact zoning and should not impact zoning enforcement."

Over the past three years, ACK Now has sponsored a series of bylaw proposals to regulate and restrict short-term rentals on the island and has funded lawsuits by Nantucket homeowners against their neighbors in an attempt to have a court rule that short-term rentals are prohibited in residential zoning districts.

"Maybe there’s something of an economic slowdown underway, that could certainly affect it," McCausland added. "I don't think this should weigh on anyone who is seriously considering voting for or against the warrant articles. Nantucket is a very cyclical environment, and this could just be an economic cycle."

The decrease in short-term rental tax revenue last summer was followed by a subdued opening day for summer boat reservations at the Steamship Authority on January 28, 2025. Reservations dropped nearly 15 percent compared to opening day in 2024.

At the Nantucket Chamber of Commerce, executive director Pete Burke said there were likely many contributing factors to the drop in short-term rental tax revenue, but his organization's data indicate the number of visitors to the island was up slightly last year. That could mean day trippers are making a comeback, he said.

"Another data source we subscribe to is Placer Ai," Burke stated. "Using their data as reference, we actually saw the number of visitors increase from calendar year 2023 to 2024 (about +2 percent), and crossing that with the rooms tax report you provided, it would suggest a slight shift towards day trips. If you add in meals tax collected from 2023 vs 2024, that was -.7 percent so essentially flat. I believe that reinforces the slight uptick in day trips, where breakfast, lunch, and to-go orders typically generate less tax revenue than dinners. As to the why, there's a fair amount of speculation here...The best I can see it, lodging ADR (average daily rate) actually stayed pretty level, both in STRs and traditional lodging across 2023-2024. With national inflation at 4.0 percent -2.9 percent range for 2023-2024, and dining out about the same increases, I would also speculate that travelers are being more price sensitive. Even if every price point (travel, lodging, food, experiences) held steady in our market, I do believe travelers are weighing where to go based on price now more than three years ago. Price isn't the only factor, and Nantucket has a strong reputation as an amazing experiential destination. I believe we can still attract new and repeat visitors."

The possibility that Nantucket has become overpriced compared to other vacation destinations has been much-discussed in the post-pandemic years, with some short-term rental properties asking $100,000 per week or more.

"It's really hard to say because there are so many different factors, but I think part of it is just a post-pandemic return to normal," said Kathy Baird, one of the founders of the group Nantucket Together, which has fought against the efforts to restrict short-term rentals on the island. "It's a self-correcting market. People are finding places to go for less money. You can go to Europe for less money than Nantucket. If the prices go too high, people will go somewhere else. And if there's a feeling that there's controversy, there's a feeling by some people that there's a risk (to renting on Nantucket). The lawsuits and the idea of it maybe being legal or not, I think people might be afraid to plunk down their money only to have it be canceled."

That possibility was echoed by Caroline Baltzer, the sponsor of a citizen petition at this year's Annual Town Meeting - Article 66 - that would codify short-term rentals in the island's zoning code as "Nantucket Vacation Rentals."

"I believe it (the decline in STR tax revenue) is partly because of the bad press ACK Now has given to Nantucket," Baltzer said. "There are people in Boston, including my friends, who have the impression that rentals are illegal on Nantucket. I think that accounts for a third of that...Also, the STR activity has gone down to pre-pandemic levels."