On Tuesday's Ballot: $34 Million In Spending Proposals

Nantucket Current •

The two contested elections aren't the only items on the ballot this Tuesday. Voters will also be asked to consider nearly $34 million in tax overrides to cover a series of seven separate spending proposals, including an annual $6.5 million appropriation for affordable housing initiatives, a new bike path along Wauwinet Road, and rising costs at the town landfill.

Below is a rundown of the seven ballot questions:

Ballot Question 1: Supplemental funding for Surfside area roads reconstruction and transportation improvements | $13 million

The tax rate impact of passing ballot question 1 on Tuesday would mean the annual tax bill for the average year-round property valued at $1.68 million and which qualifies for a residential exemption will increase by approximately $30.90 annually for 20 years.

Ballot Question 2: Supplemental Funding For Landfill Closure Costs | $5 million

The tax rate impact of passing ballot question 2 on Tuesday would mean the annual tax bill for a year-round property valued at $1.68 million and which qualifies for a residential exemption will increase by approximately $11.73 for 20 years.

Ballot Question 3 – Supplemental Funding: Wauwinet Road Shared Use Path | $4.6 million

The tax rate impact of passing ballot question 3 on Tuesday would mean the annual tax bill for a year-round property valued at $1.68 million and which qualifies for a residential exemption will increase by approximately $10.81 for 20 years.

Ballot Question 4: Appropriation for the Nobadeer Playing Fields Complex - Field Addition; Associated Renovations to Adjacent Fields; Site Enhancements | $3.8 million

This spending proposal was defeated at Town Meeting, so even if it is approved on the ballot vote, the tax override will not be authorized. Even so, proponents have mounted an informal campaign to approve the ballot question nonetheless to send a message to the town that many families would like to see the field improvements.

Ballot Question 5 - Appropriation for General Fund Capital Expenditures | $970,000

This ballot question would authorize a $970,000 debt exclusion override to fund equipment and vehicles for the Nantucket Fire Department, security cameras and lighting at various parks and recreation locations, funding to replace a fuel tank at the DPW, and grounds equipment for the public school district. The tax rate impact of passing ballot question 5 on Tuesday would mean the annual tax bill for a year-round property valued at $1.68 million and which qualifies for a residential exemption will increase by approximately $31.31 for just one year.

Ballot Question 6 – Appropriation forAffordable Housing Trust Fund | $6.5 million

This permanent tax override would provide funding for affordable housing initiatives on Nantucket, and would be managed by the Affordable Housing Trust. The tax rate impact of passing ballot question 6 on Tuesday would mean the annual tax bill for a year-round property valued at $1.68 million and which qualifies for a residential exemption will increase by approximately $211.30.

Ballot Question 7 - Appropriation: Fiscal Year 2024 Enterprise Funds Operations | $3.75 million

This tax override would cover a potential revenue shortfall in town's the Solid Waste enterprise fund. The proposed appropriation of $3.75 million will explicitly be used to fund the operations of the Solid Waste enterprise from the Town’s tax levy and general revenues. Approval of this ballot question would mean that the annual tax bill for an average year-round property valued at $1.68 million and qualifies for a residential exemption will increaseby by approximately $121.76.

Polls will be open from 7 a.m. until 8 p.m. at Nantucket High School, and results are expected in the hours following poll closure.

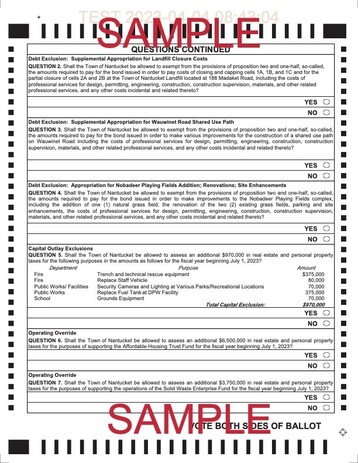

A sample ballot showing the ballot questions is below: